In a volatile week dominated by fears over President Trump’s aggressive tariff policy, Warren Buffett’s Berkshire Hathaway emerged as a symbol of stability. As markets tumbled—the S&P 500 by 9.1% and the Nasdaq by even more—Berkshire’s Class B shares fell only 6.2%, reflecting investor preference for resilient holdings.

Berkshire’s strength lies in its diverse portfolio, spanning insurance, railroads, energy, and retail. Unlike tech-heavy peers, its domestic focus and broad asset base helped buffer it from trade-related shocks. Notably, it remains above its 200-day moving average, a marker of investor confidence and long-term stability.

Investor psychology played a key role in this dynamic. During economic uncertainty, capital often flows to perceived “safe havens.” With $334 billion in cash reserves and minimal exposure to politically sensitive sectors, Berkshire is seen as insulated from policy swings. This positions it as a rare, stable giant in a market rattled by unpredictability.

Trump’s policies have fragmented the market, putting politically tied firms at risk. In contrast, Berkshire thrives with minimal government entanglement. As Ritholtz’s Josh Brown noted, its structure shields it from the chaos faced by more exposed corporations.

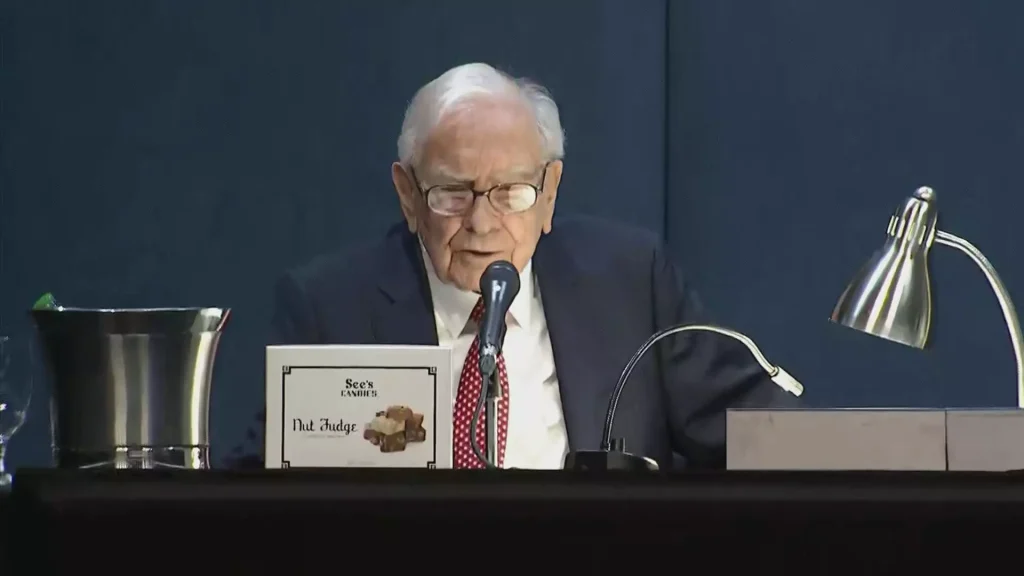

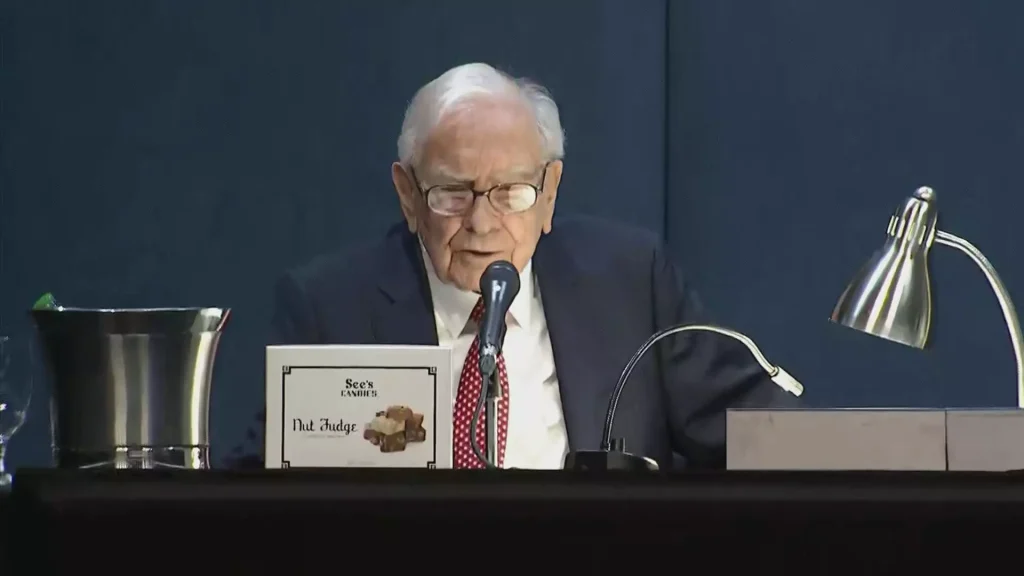

At the helm stands 94-year-old Warren Buffett, whose steady hand and long-term vision continue to inspire confidence. Despite social media rumors linking him to Trump’s market criticism, Buffett quickly denied the claims, reinforcing his focus on fundamentals over political narratives.

Berkshire’s performance amid the storm isn’t just a case study in diversification—it highlights the power of psychological security, strategic independence, and steady leadership in turbulent times.